You may have heard that, at this moment in time, the opportunity to maximize your buying power on a home mortgage is ripe. But, what does that really mean? What’s different about buying a home now vs. years past? So, we’ve put together a list to help explain why now might be just about the best time ever to buy a home.

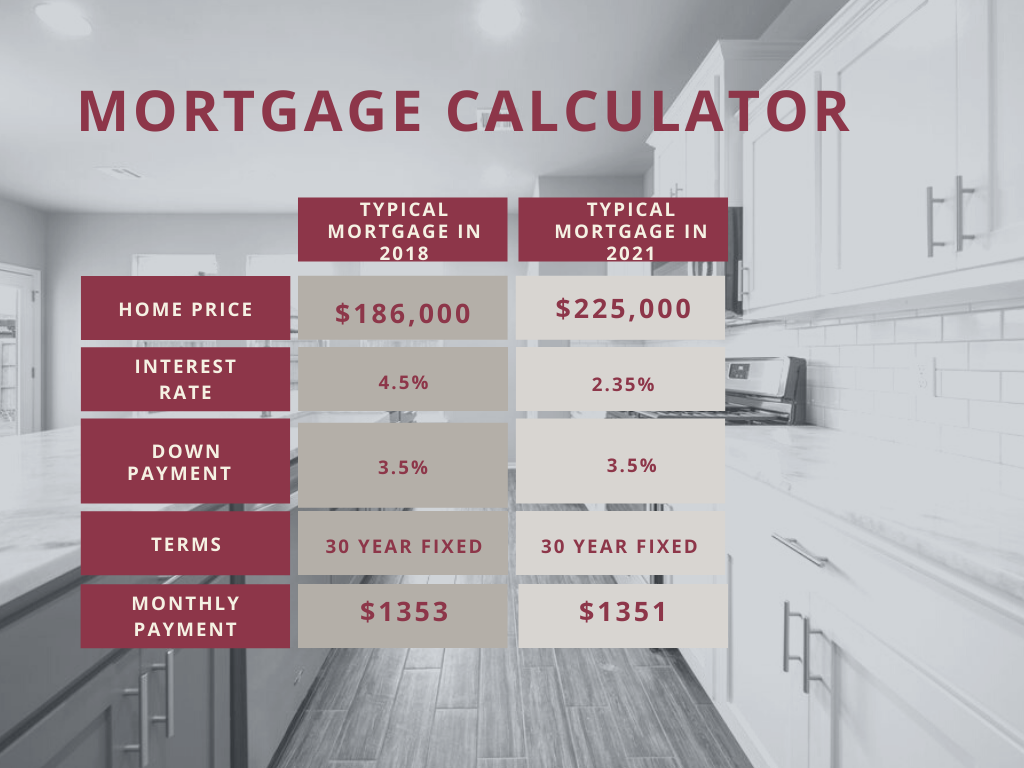

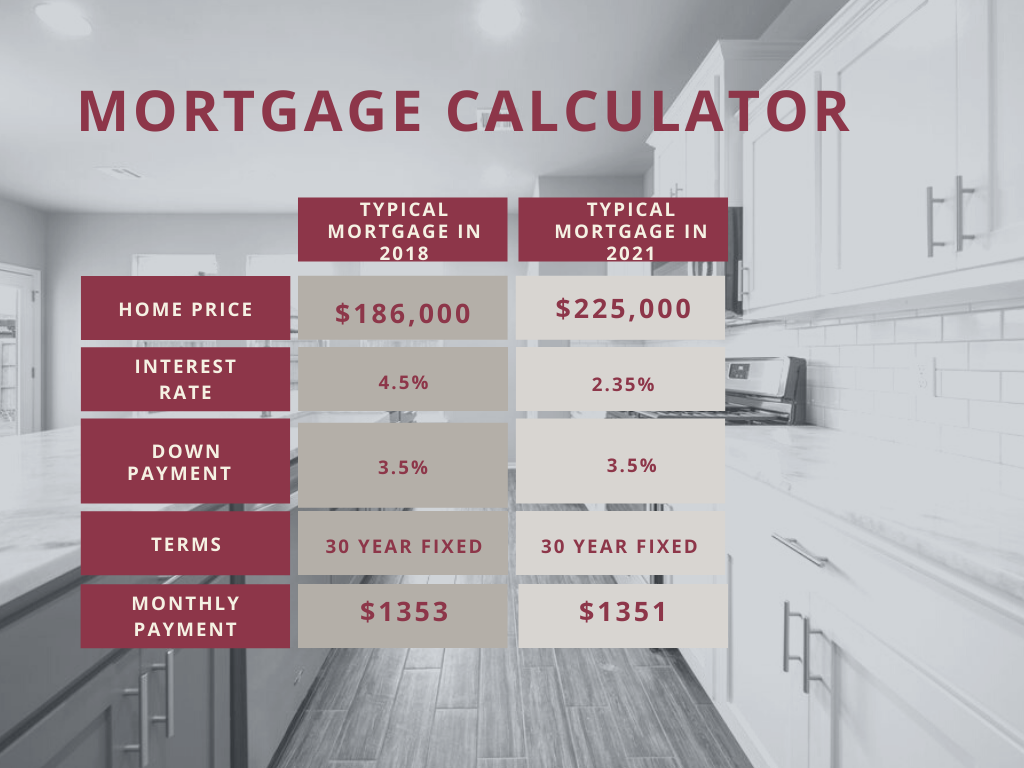

Interest rates are historically low. With interest rates hovering anywhere from 2.25 to 3%, today’s home buyers are saving a record amount on interest each month.

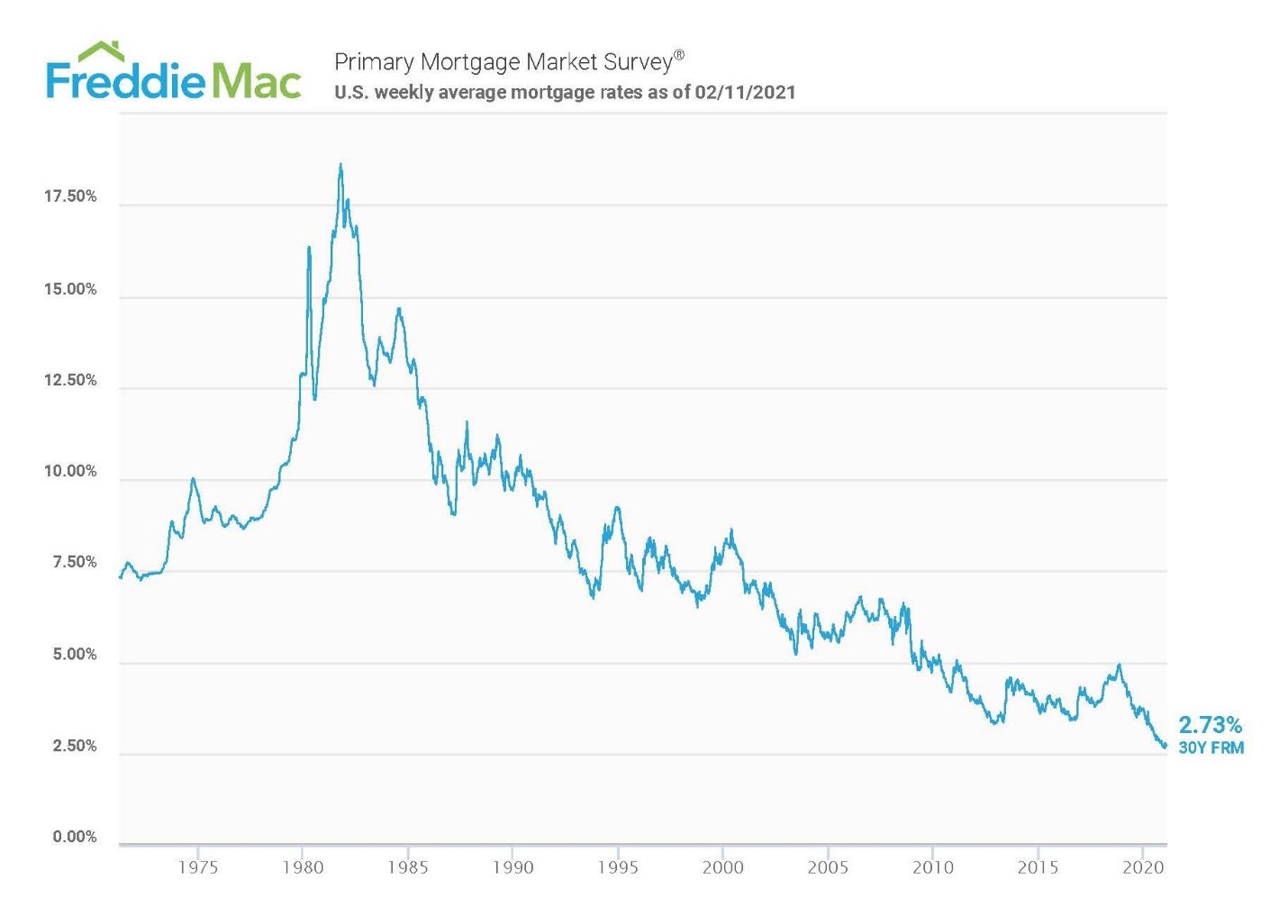

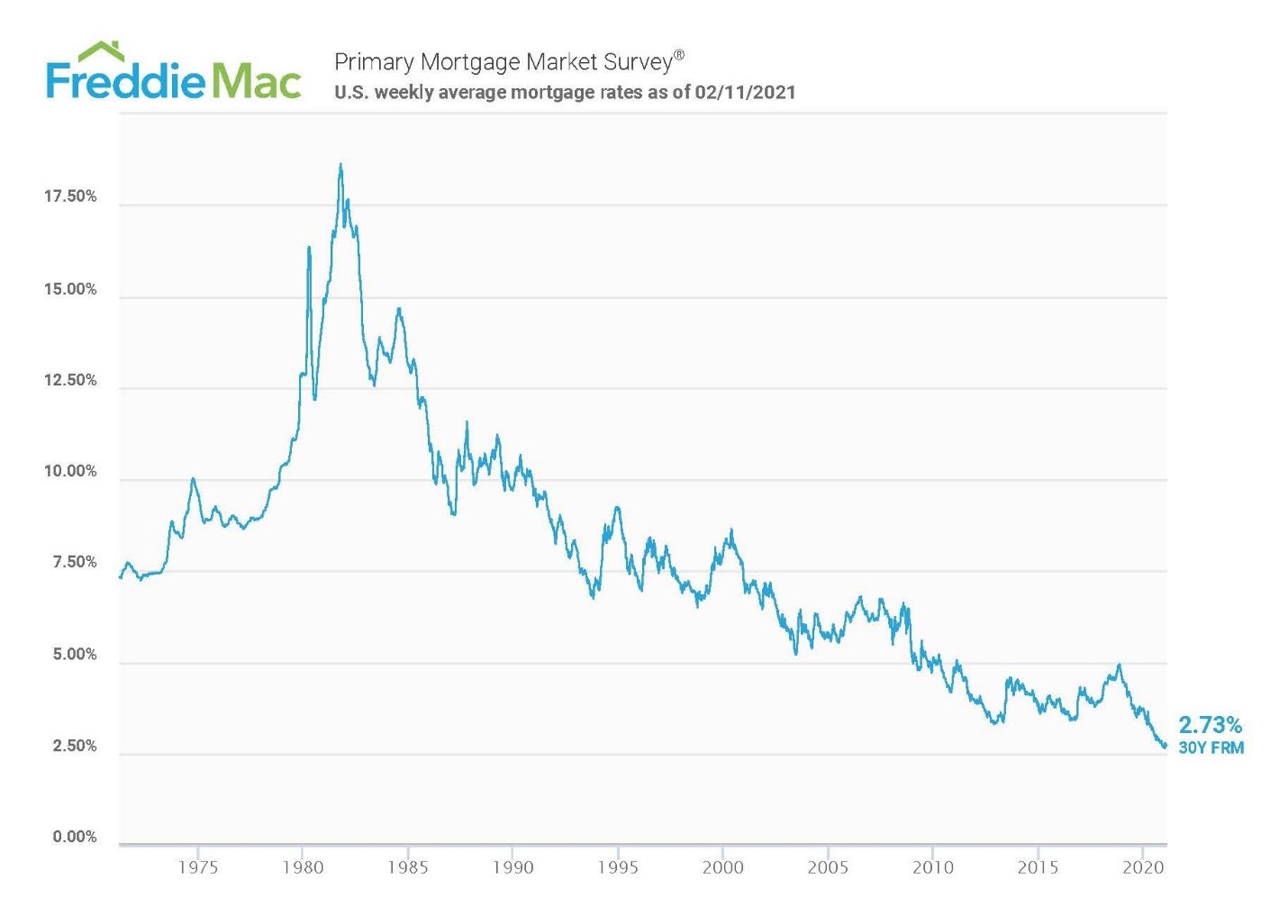

According to an article in the Washington Post, “The 30-year fixed rate has never been this low since Freddie Mac began tracking mortgage rates in 1971. It surpassed the previous low of 2.71 percent, set earlier in the month. For some context on how remarkably low rates are, since November 2018, when it was 4.94 percent, the 30-year fixed rate has fallen more than 2.25 percentage points. At the start of 2000, the 30-year average was 8.15 percent.”

Such low rates are practically unheard of, historically speaking, and can have a significant impact on your monthly payment and overall lifetime payment on a new home.

Financial assistance programs are available. There are some great loan options out there right now that you can take advantage of whether you are a first-time homebuyer or not. Keep an eye out for our next post about Financing Programs to learn more about what may be available to you.

Closing cost assistance is available through Capital Homes. This one is only for Capital Homes buyers, but we pay up to $4,000 in closing costs when using one of our preferred lenders, making that closing date much easier on your bank account – especially when combined with a great loan or financial assistance program, and historically low interest rates.

“The savings you’ll see on your down payment, closing costs, and monthly payments could make the difference on whether you can afford to buy a home, or the kind of home you are able to buy,” said Grant Deyoe, RCB Bank Preferred Lender for Capital Homes. “We are seeing a lot of renters who are just shocked that they are paying the same in rent that they could be paying on a new construction home that they own.”

If you’re considering purchasing a home, you owe it to yourself to find out what opportunities are available to you.

Give us a call and we’ll help you get started.